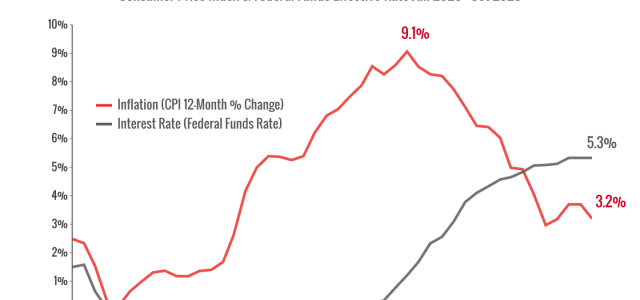

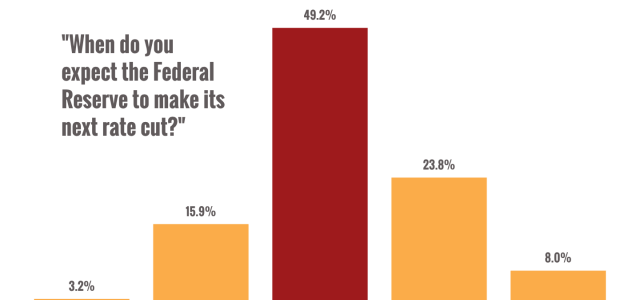

As we kick off 2024, the latest data is raising some concerns about inflation. Let’s dive into some data and take a look.

Read More

As we enter the final weeks of 2023, let’s take a moment to review some of the year's major market and economic trends.

Read More

Happy Thanksgiving! I’m grateful for you.

Read More

Do you feel like the economy isn’t making a lot of sense right now? There’s a big divide between the current data and what many Americans are feeling.

Read More

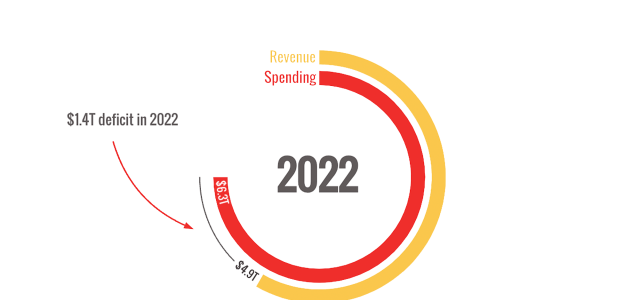

What's going on with markets? Why does the federal government keep getting into fiscal fights? A lot is going on, so let's discuss.

Read More

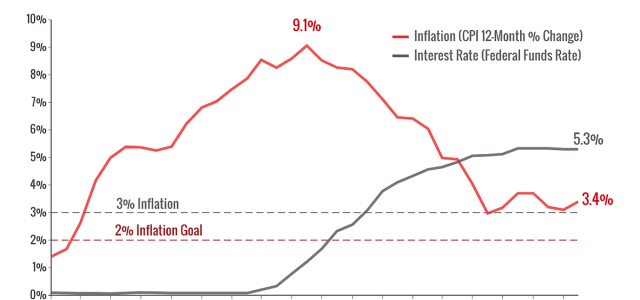

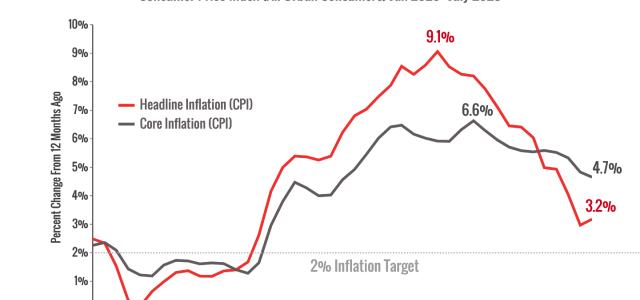

How high do you think the Federal Reserve will have to push interest rates to fully tame inflation? Let’s discuss.

Read More

Interest rates are going up, but inflation is going down. Are we going to see a recession? Let’s discuss.

Read More

Markets have been hitting some positive milestones lately, but it’s not clear whether or not the bear market is actually over just yet. Let’s discuss.

Read More

A clear understanding of what wealth looks like to you may help you build a financial strategy.

Read More

From retirement savings to living abroad, here are some of our commonly asked questions.

Read More

A gap analysis can help you see if you’re still on track to pursue your financial goals.

Read More